Table of Contents

A lot of swindling happens when you share an inheritance with a sibling. Some siblings feel entitled to overseeing the estate and colliding with probate matters because they have power of attorney.

Luckily, inheritance laws lay bare the legal guidelines you can follow to enjoy your rights as an heir or beneficiary. So, you must know what to do when you suspect foul play like unfair estate distribution, forced property sale, etc.

This guide provides an overview of inheritance between siblings, including intricate issues like untrustworthiness and conflicts.

Key Takeaways

- Siblings can jointly inherit an estate when named in the Will or following intestacy laws.

- Some of the common issues when you share an inheritance with a sibling, include how to divide the properties equally and how to meet the aspirations of each.

- Fortunately, siblings can always reach an amicable solution to settle disputes or take the matter before the court of law for a determination.

How To Inherit as A Sibling

Inheritance rights

Siblings can inherit the same estate differently, such as appearing in a Will when no other close relative is alive or the next of kin in intestacy.

Below is a more detailed look into how siblings can inherit an estate and what the laws require.

Nonetheless, inheritance laws can be complex and vary depending on the jurisdiction, so sync up with your attorney.

Inheritance Through a Will

The Will serves as the testator’s last wishes on how they wish to distribute their estate. In this case, your parents indicate you and your siblings as their heirs and other beneficiaries. In the same way, other people could name you and your siblings as the beneficiaries of their estate.

Order Of Intestate Succession

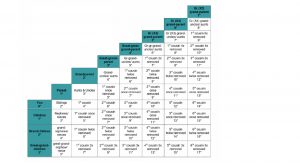

When a person dies without a valid Will (intestate), estate distributions become subject to the probate process, which follows intestacy laws. According to the law, the order of succession should be hapen in regard to degree of kinship as stipulated in the table of consanguinity (see below).

Table of Consanguinity

As you can see in the table above, the testator and the spouse are numbered “0” and named “You.” The inheritance priority is stipulated to follow the degrees of consanguinity starting with the smallest column.

A spouse is always the most entitled, then the descendants and the decedent’s parents. If none of these relatives is alive, siblings come into play for an equal share.

Therefore, according to the table of consanguinity and the law, inheriting from your sibling is more likely when they die intestate or have you in their Will. Even if they don’t include you in the Will, you could still inherit the estate if the benefactors named in the Will are themselves deceased.

Can A Half Sibling Inherit Like a Full Sibling?

The chances of step-siblings inheriting the estate like full siblings depend on what makes them half-siblings in the first place. Are they biologically connected with the other siblings? Are they adopted into the family?

For adopted siblings, they would only succeed in pursuing sibling inheritance if they were legally adopted into the family. As for the biologically connected sibling, some DNA tests and an accurate genealogy report could help make your case before the probate judge.

How To Handle Inheritance with A Sibling

Conflicts are common in estate planning involving siblings

Conflicts with your siblings about inheritance can be a complex situation to handle, but they’re inevitable when dealing with a mean or hostile sibling. Many of these disagreements emerge during the distribution of properties such as real estate, cars, and houses.

If you’re the estate executor, you must reflect the testator’s wishes on the property. And since trustees and executors are fiduciaries, they are allowed to decide about an estate provided it is for the best of the trust or estate, respectively.

However, if you’re a beneficiary, you must be clear on your possession percentage and the decedent’s wishes on the property. If you have divergent opinions about handling the cars or house, consider hiring a property dispute lawyer to represent your interest and enforce rights regarding the inherited property.

How To Sell a House Inheritance with A Sibling

Ensure accurate asset valuation

You can bring up a partition action to sell a shared house inheritance with a sibling. According to the law, a person may not be forced to own a property they don’t want but can be forced to sell a property they want.

However, the partition action can be costly and time-consuming, so co-owners would better discuss the options. Common options include having the property occupiers pay the non-residing sibling or having the residing siblings buy the other out of their interests over a given period.

Be sure to check updates in your state to remain updated on partition laws, mainly on cases involving heirs’ property.

What Happens When One Dies in Jointly Inherited Property?

The fate of an inherited property after the death of one party depends on whether the title is held as tenants-in-common or joint tenants. Tenancy-in-common provides equal shares to the owners without the right of survivorship.

So, if a co-owner passes on in this case, the property will be subject to the intestate succession laws. However, joint tenancy allows the transfer of the deceased co-owner’s interests to the living co-owner.

How To Request Rent from Siblings in An Inherited Property

You should agree on payments

If your siblings are occupying a jointly inherited house, you can legally make them pay you. However, it would be best if you were sure that you own a percentage of the house and that the original owner didn’t provide the occupants with the enjoyment of the house for life.

However, if you have the same rights to the property, but the other sibling has taken complete control without your explicit permission, you need to consider taking legal action. Options include evicting them, getting a judgment for unpaid rent, or initiating a partition lawsuit.

How To Manage a Mortgage Inheritance with A Sibling

If siblings inherit a house with a mortgage, quick options include continuing to pay for it or selling it. Siblings may decide to sell and share the proceeds or keep the house.

It is always possible for siblings to agree on the best way forward. When the siblings involve minors, the most capable sibling may agree to complete the payment and let the others pay back over time.

Whatever your decision, you should not default on the mortgage, as the house could be subject to foreclosure.

If the decedent’s home has a mortgage, the estate administrator or executor can decide to continue making the payments from the estate or sell the property and distribute the cash to the siblings as inheritance.

Settle the Sibling Rivalry in Inheritance

Reaching resolutions is possible, but many cases involving inheritance with a sibling end up in court. While the court should be the right way for anyone fighting for their rights, the process can be costly and adversely affect the involved parties.

Therefore, it is advisable to try and solve all the issues with your siblings amicably before taking them to court. No one wishes to undergo a tedious legal process and additional costs, especially when grappling with the loss of a loved one.

Hire Record Click experts to help you smoothly work out the estate settlement and probate process to avoid the stress of estate battles with a sibling.

Contact us today to schedule a private consultation to start the process.